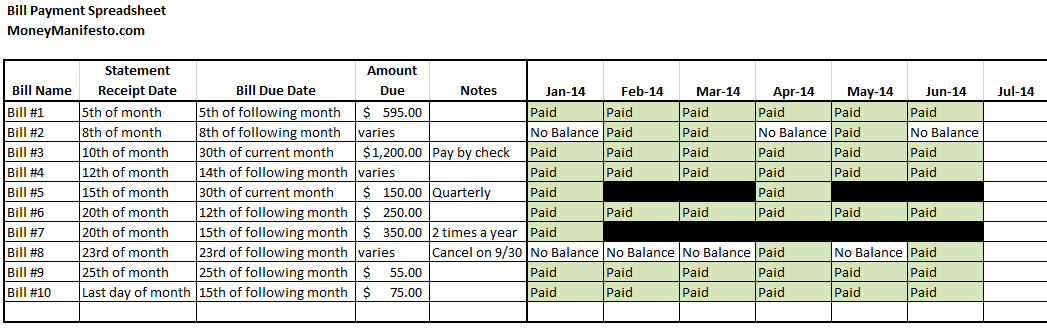

They keep all your Bills organized in one place so you know exactly where you stand with every Vendor, every month.

To help, FreshBooks has added new Accounts Payable features. Long story short, it can be tough staying on top of every payment, when your real focus is on your clients.

For example, your landlord may only accept checks, or your bank may prefer to get paid electronically by a certain date. Chances are you carry a certain amount of overhead every month: Rent for your studio space, monthly internet bills, maybe even a small business loan.Īnd every month, you try your best to follow the paper trails and digital breadcrumbs of each vendor. This process can also unearth bookkeeping errors, projected cash shortfalls or other discrepancies between budget projections and actual experience.Let’s say you’re a personal trainer with a growing list of clients and a robust roster of vendors you work with. Regular balancing of ledger entries and review of budget projections can help a business owner see where he is in relation to his business goals. Review your business accounting entries regularly to obtain a picture of your financial health and to correct any bookkeeping errors. The Internal Revenue Service recommends retaining tax records for three years under normal circumstances, and up to seven years for securities losses or bad debt. When you complete your ledger entries, file the receipts in the appropriate locations. When you start your cake business, create a central filing system with separate files or folders for each expense category. Keep all business invoices and receipts as this is vital for reconciliation of bookkeeping errors and is important for substantiation of tax deductions. This will also allow you to better track and keep pace with business growth. Many small businesses use a checkbook as a means to track expenses and income, but using a ledger based on a defined chart of accounts is a more accurate depiction of financial health. After final payment by the client and delivery of your cake, enter the final expenses and income into a ledger and retain all documentation. At the start you might keep a separate file for each client to store receipts and invoices.

Keep an accurate ledger of expenses and update the ledger regularly. The complexity of the chart of accounts depends on the size of your business, whether you use cash or accrual accounting, and how fast you wish your business to grow. This documentation will help you identify types of expenses and sources of income. Some examples of expense categories for a cake business might be "ingredients" and "cooking supplies," plus packaging materials for shipping your products. A chart of accounts helps you categorize all financial aspects of your business, including cash, income and expenditures. Develop a chart of accounts for your cake business.

0 kommentar(er)

0 kommentar(er)